On behalf of First National Wealth Management, thank you for the continued confidence you have placed in us. 2020 marked our 103rd year in business providing Trust and Wealth Management services, and we ended the year with a new record level of assets under management. We are humbled by this fact and realize the importance of the responsibilities you have entrusted to us. We are committed to the continued success of our partnership. We hope you find value in this 2020 market and economic review. Should you have any questions regarding this material or anything else, please feel free to contact us.

Client-centered focus

In 2020 we continued to roll out our comprehensive financial planning service called “Wealth Advisory.” This service allows us to provide in-depth financial planning to our wealth management clients, building on our reputation as a premier provider of wealth management services under the fiduciary standard. We also increased our delivery of original personal finance content including our Positions newsletters and our “Common Cents on the Prairie” podcast. All of our content can be found on our website, and the podcast can be found everywhere you listen to your podcasts. As it has been for more than 100 years, our goal is to be your most trusted financial partner and make your lives easier and better. Our original content is meant to keep you abreast of our viewpoints in a more real-time fashion than this annual letter allows.

2020 market review

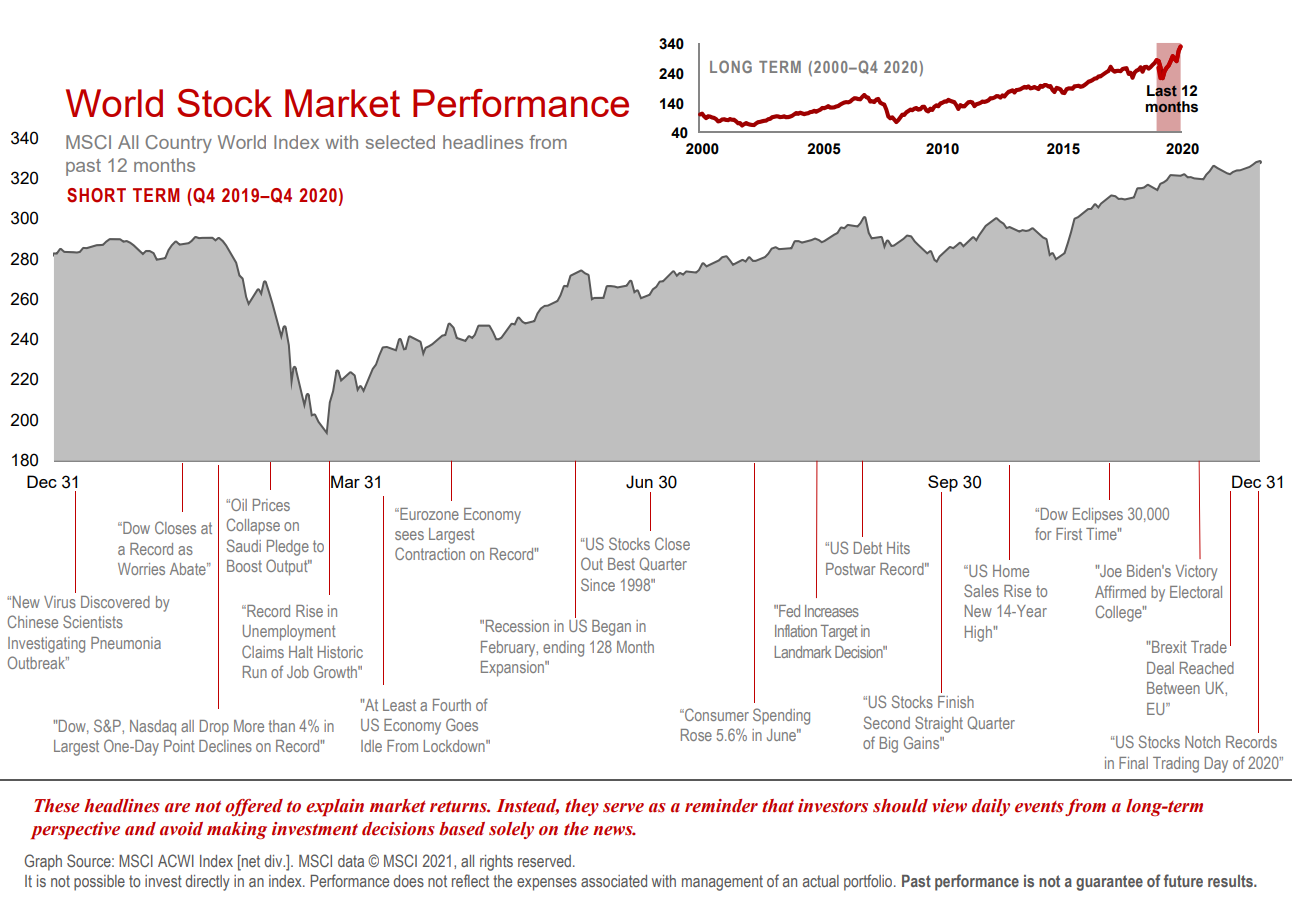

The year 2020 proved to be one of the most tumultuous in modern history, marked by a number of developments that were historically unprecedented. But the year also demonstrated the resilience of people, institutions, and financial markets. Uncertainty remains about the pandemic and the broad impact of the new vaccines, continued lockdowns, and social distancing. But the events of 2020 provided investors with many lessons, affirming that following a disciplined and broadly diversified investment approach is a reliable way to pursue long-term investment goals.

Equity Market Highlights

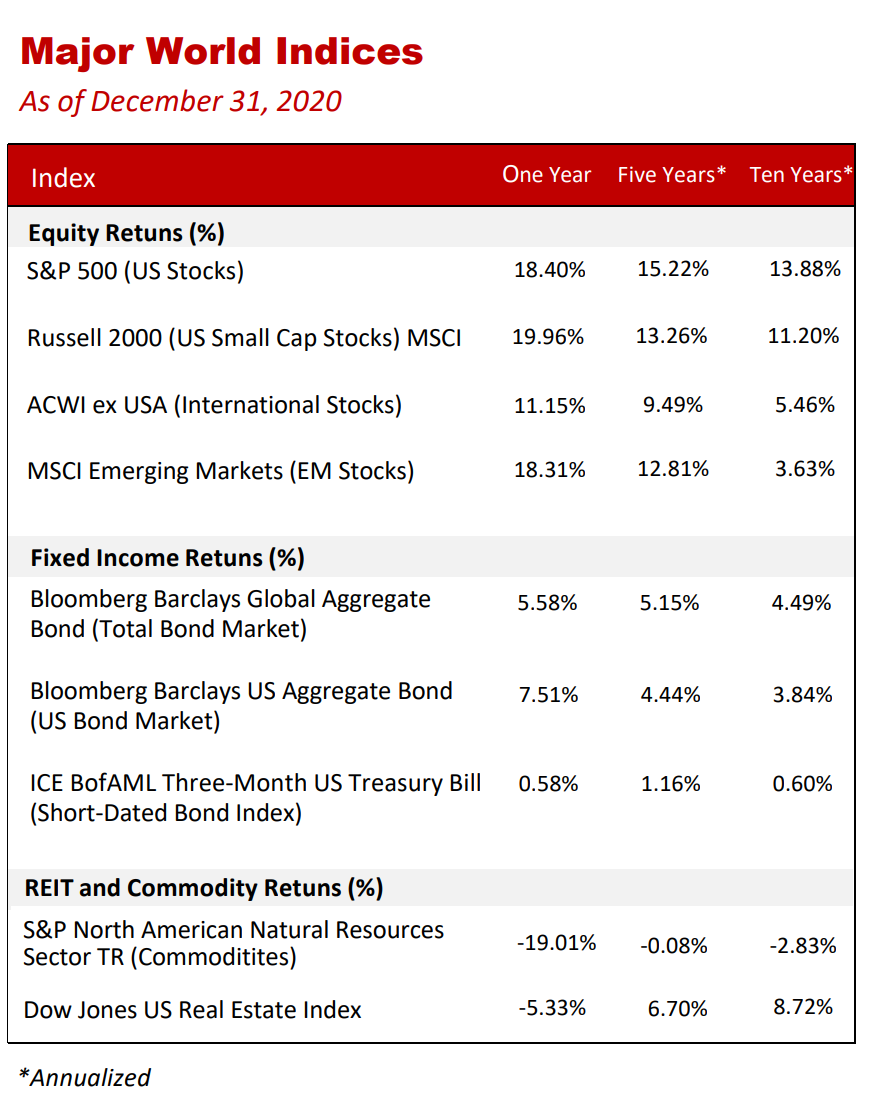

The year was characterized by sharp swings for stocks. March saw the S&P 500 Index’s decline reach 33.79% from the previous high as the pandemic worsened. This was followed by a rally in April, and stocks reached their previous highs by August. Ultimately, despite a sequence of epic events and continued concerns over the pandemic, global stock market returns in 2020 were above their historical norm.  The US market finished the year in record territory and with an 18.40% annual return for the S&P 500 Index. Non-US developed markets, as measured by the MSCI World ex USA Index, returned 7.59%. Emerging markets, as measured by the MSCI Emerging Markets Index, returned 18.31% for the year.

The US market finished the year in record territory and with an 18.40% annual return for the S&P 500 Index. Non-US developed markets, as measured by the MSCI World ex USA Index, returned 7.59%. Emerging markets, as measured by the MSCI Emerging Markets Index, returned 18.31% for the year.

Fixed Income Highlights

Fixed income markets mirrored the extreme swings of equity behavior during the first half of 2020. With the Fed dropping rates to near zero and implementing an unprecedented buying spree, US Treasury yields fell across the board, with drops of more than 1% on the short and intermediate portions of the curve. The US Treasury curve ended relatively flat in the short-term segment but upwardly sloped from the intermediate- to long-term segment. For 2020, the Bloomberg Barclays Aggregate Bond Index returned 7.51% and the Bloomberg Barclays Global Aggregate Bond Index returned 5.58%.

Tax update

As part of the CARES Act passed in March, most Americans received direct federal payments in the form of stimulus checks, with exclusions for joint filers making more than $150,000 ($75,000 for singles). For those who received stimulus checks from the IRS, they will be treated as advance payments of what will be called a recovery rebate credit. These amounts are not taxed, but will be reported on your tax return.

For 2020, taxpayers who do not itemize and take the standard deduction can take a deduction of up to $300 for monetary donations to qualifying nonprofits. For 2021, this applies and married couples filling joint can take up to a $600 deduction. The standard deduction amounts for 2020 increased to $24,800 and $12,400 for married filing jointly and single filers respectively. Taxpayers who do itemize their deductions are not subject to any caps on the amount of cash donations they can deduct in 2020 and 2021.

Contribution limits on retirement accounts were unchanged during the year. The maximum an employee can contribute to a 401(k) remains $19,500 with the catch up amount still $6,500 for those born before 1972. These limits apply to 403(b) and 457 plans as well. The cap on SIMPLE IRAs is also unchanged at $13,500, with people age 50 and older able to put in $3,000 more. The 2021 contribution limit for traditional IRAs and Roth IRAs remains $6,000 ($7,000 if you are over 50). As a reminder, you have until April 15th, 2021 to make your IRA contributions for the 2020 tax year. Please let us know if we can assist. The estate tax exemption increased to $11.58 million in 2020, with $23.16 million available to couples, and the gift tax exclusion remained fixed at $15,000.

On staying humble part II

Last year we wrote regarding 2019, “Perhaps the biggest takeaway for the year was the reminder of just how unpredictable markets can be…such a dramatic turn of events should remind all investors (ourselves included) to never be too sure of future outcomes, no matter how certain they may appear.” We reiterate that sentiment regarding 2020. Many professional investors, TV personalities, government officials, your friends and family, et al., like to give you very confident predictions on what is next for the economy and markets. They do it because they know humans crave certainty, especially in difficult times, and because nobody keeps score on their past predictions (it would be a bleak record). We ignore all of that. The future is unfathomable, so we don’t make explicit market forecasts and we certainly don’t let anyone’s predictions guide our investment decisions. So what? How does this affect how we manage your money? First, we have the attitude that markets will always surprise us. We know bad things will happen. We don’t know when, but we are prepared. We prepare by planning ahead for any potential cash needs so that we are not forced to sell at a bad time. We get to know your goals early in our relationship to make sure that your investments are suitable for your risk tolerance and time horizon. We study stock and bond market fundamentals and valuations (we won’t bore you with the details), and we are always ready to act on the bargains that appear in a market panic. We were busy on that front in 2020.

In the end, the best investment portfolio for you is the one you can stick with in good times and bad. Doing so allows you to sit confidently and allow the magic of compounding to grow your wealth.

Once again, thank you for your continued trust in us. Please contact your administrator if you would like to schedule a time to visit with us about your portfolio or other ways we could serve your financial needs. We are happy to accommodate a Zoom or in-person meeting. In the meantime, we will stay focused on finding the best opportunities we can and adjusting your investments accordingly.