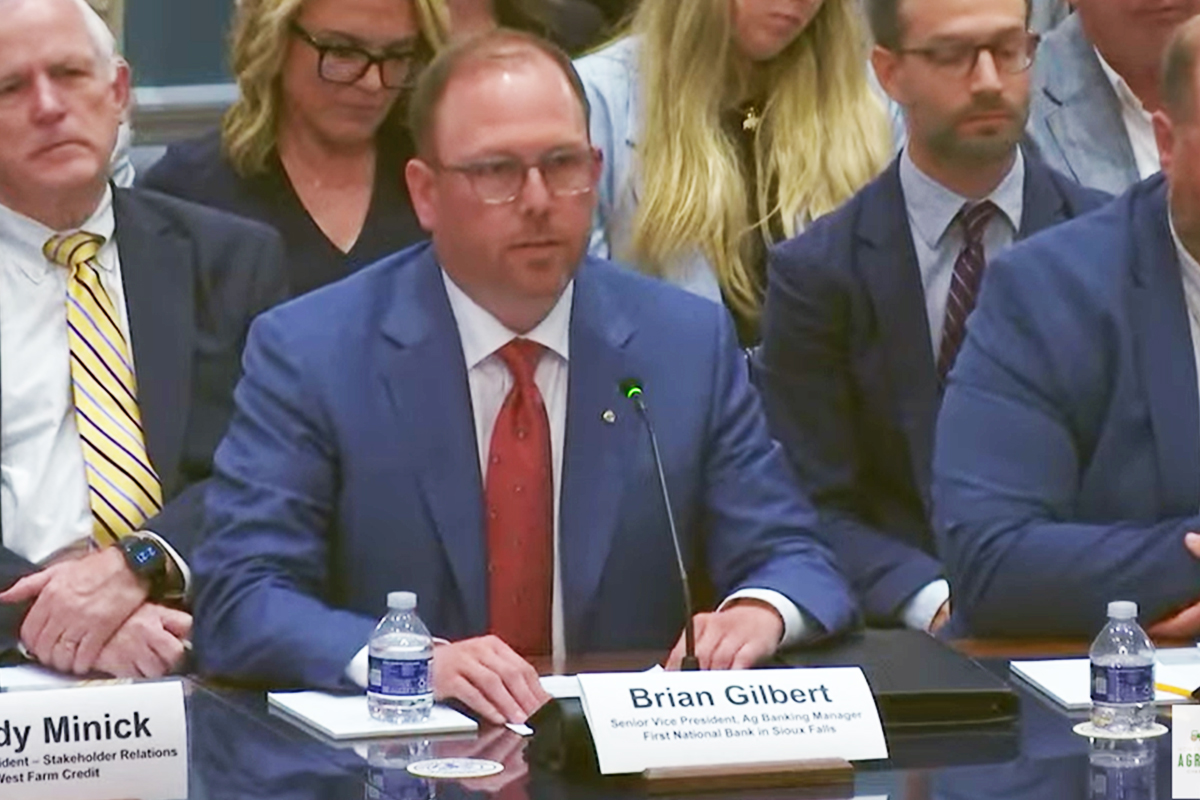

Brian Gilbert gives pro-agriculture testimony before Congress

Ag Banking Manager Brian Gilbert recently testified before Congress on the importance of community banks and pro-agriculture policies for family farms.

As Congress considers passing a new farm bill, with the current legislation set to expire on September 30, 2025, lawmakers heard from four witnesses in the ag lending and farming industries.

Brian represented the Independent Community Bankers of America (ICBA), for which he serves on the Rural America and Agriculture Committee.

“Our nation’s more than 4,000 community banks make nearly 80% of all ag loans made by commercial banks, or $151 million,” Brian said in his testimony to the House Agriculture Subcommittee on General Farm Commodities, Risk Management, and Credit.

He went on to describe community banks as “relationship lenders that fund local loans with local deposits.”

On behalf of the ICBA, Brian expressed the need for a USDA Express loan program.

This program would require the USDA to approve loan applications for up to $1 million within 36 hours in exchange for a lower guarantee amount.

Brian also brought concerns about expanding the Farm Credit System (FCS) based on current proposals.

“The Farm Credit Act should be tightened to limit FCS deposit-taking activities, which is draining community banks of deposits,” he said.

To conclude, Brian thanked Congress for the $10 billion in economic loss payments, $20 billion in disaster aid, and higher reference prices and continued crop insurance protections included in the One Big Beautiful Bill Act.

Brian has worked in agricultural lending for 20 years, and he owns and operates a family farm that raises cattle, corn, and soybeans.

To learn more, you can watch Brian’s testimony before Congress or read his full, written testimony.

We support family farms

From community involvement to industry expertise, learn what sets our Ag Banking team apart.

Let's Go