So, it’s a new year and one of your resolutions is to budget better.

You’ve read our blog “Budgeting 101: Finding the right budget for you,” and you’ve decided which type of budget to implement. Now, you need to make yourself stick to it.

It’s easy to choose a type of budget and put it into action, and maybe the first few weeks or even months go by without a hitch, but the hard part of budgeting is staying with it for the long term. If you’ve got a budget picked out and now need ways to hold yourself accountable, here are some strategies you can use to make your budget stick!

Zero-based budget

Using a zero-based budgeting system is all about giving a purpose to every cent you earn. The goal here is that, at the end of every budget cycle, your income minus your expenditures amounts to zero.

Don’t get ahead of us yet — that doesn’t mean you have to spend every single dollar you earn. Rather, it means that leftover money from your expense categories moves elsewhere, like to an emergency fund, your savings account, or paying off debt.

This system is most effective for those looking to get out of or stay out of debt, as it involves tracking every dollar you spend and making sure you’re putting your money to good use.

On the other hand, this is one of the more meticulous ways to maintain a budget because it is so involved. If you want alternatives to the zero-based system, keep reading to see what else you can do to enforce your budget.

Envelope system

The envelope system works best with budgets that utilize spending categories. With this strategy, you write each category (food, gas, entertainment, etc.) and its allotted amount ($20, $200, $5, etc.) on an envelope. Then, you fill each envelope with cash equal to the specified amount.

Each time you plan to spend on something, remove enough money from that envelope. For example, if you have an envelope labeled “clothes,” you would take money out of that envelope to buy a new pair of shoes.

The beauty of the envelope system is that it splits up your money to prevent overspending. And because you’re using cash, you can avoid racking up debt by only paying with money you already have.

However, the envelope system can be tedious and doesn’t work with online shopping. That’s why people have started doing it digitally with spreadsheets or apps like Goodbudget, NerdWallet, and Mvelopes.

If the envelope system isn’t right for you, or you’re doing a savings budget with no expense categories, there are more ways to hold yourself accountable.

Automatic payments and transfers

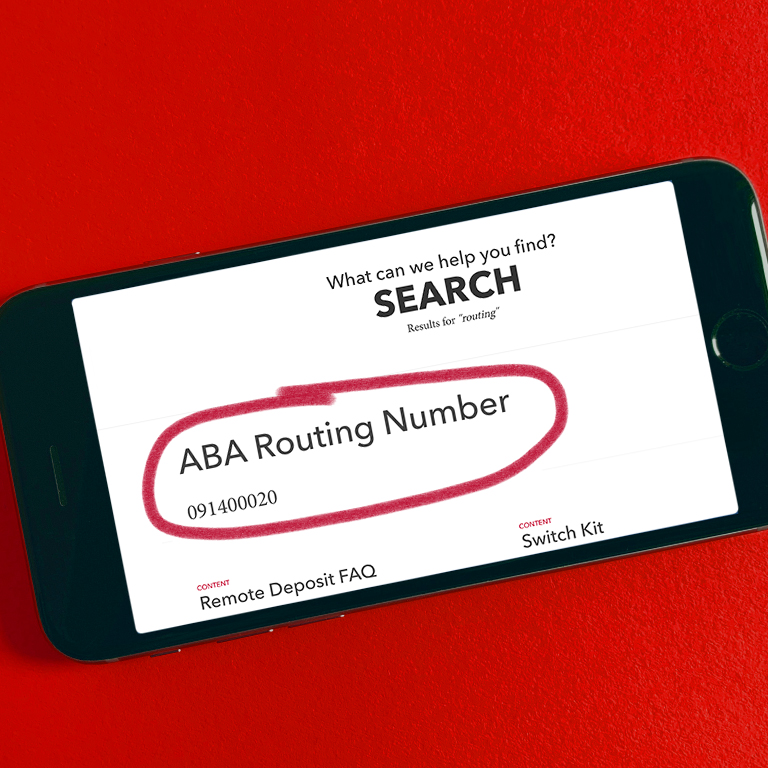

Setting up automatic payments and money transfers is beneficial for any budget and especially useful with a savings-based budget.

You can set up automatic payments for most recurring charges and bills, including rent payments and even your credit card bill. Doing this will ensure that you never miss a payment or spend that money on other expense categories.

Meanwhile, you can set up automatic money transfers to fill up your savings account. The best method is to set a percentage of each paycheck to go straight into your savings account; that way, you won’t even have a chance to spend that money before it goes to savings.

You can also set up recurring transfers from your checking account to your savings for whenever you feel most comfortable moving that money.

And while saving money is like treating your future self, there’s one more way to help you stick to your budget — and we promise, it’s a fun one.

Treat your present self

Treat your present self

Budgeting can sometimes be a dull and tedious process; however, you’ll find yourself more inclined to stick to your budget if you know there will be a reward at the end of it.

A hefty savings account and retirement plan is a reward for your future self, but your present self may need an incentive to keep going too.

That’s why you should treat yourself every time you reach a budgeting goal! Because budgeting is all about making your life better through financial stability, it shouldn’t be a stressor.

Make a game out of your budget by setting goals for saving and reducing debt; then, treat yourself any time you reach one of those goals. Also, make sure you keep room in your budget for “fun money” so you can enjoy life now as much as you will in the future.